Nearly A Million Jobs Vanish In Largest BLS Revision Ever As Labor Department Launches Probe – Financial Freedom Countdown

The U.S. economy added 911,000 fewer jobs over the past year than previously reported, the Bureau of Labor Statistics (BLS) confirmed this week.

The revision represents the largest annual downward adjustment on record, cutting reported job growth by more than half and raising fresh doubts about the reliability of official employment data.

Labor Department Moves Quickly After Stunning Jobs Revision

One day after the BLS disclosed the revision, the Department of Labor announced an investigation into how the agency collects and reports its closely watched economic data.

Industries Hit Hardest by the Cut

The job losses were uneven across sectors.

The leisure and hospitality industry; including restaurants and hotels, lost 176,000 jobs compared to prior estimates.

Retail, professional and business services, wholesale trade, and manufacturing also saw significant downward adjustments.

In percentage terms, the information sector experienced the steepest hit.

These revisions suggest that sectors once thought resilient were, in fact, underperforming.

Markets Brace for Fed Decision

The timing of this data release is critical.

With weaker-than-expected job growth, the Federal Reserve faces mounting pressure to cut interest rates at its September 17 meeting.

Unemployment in August climbed to 4.3%, and futures markets now assign a 99% probability of at least a quarter-point rate cut.

The revised data sets a new baseline for assessing labor-market strength, potentially influencing monetary policy decisions for months to come.

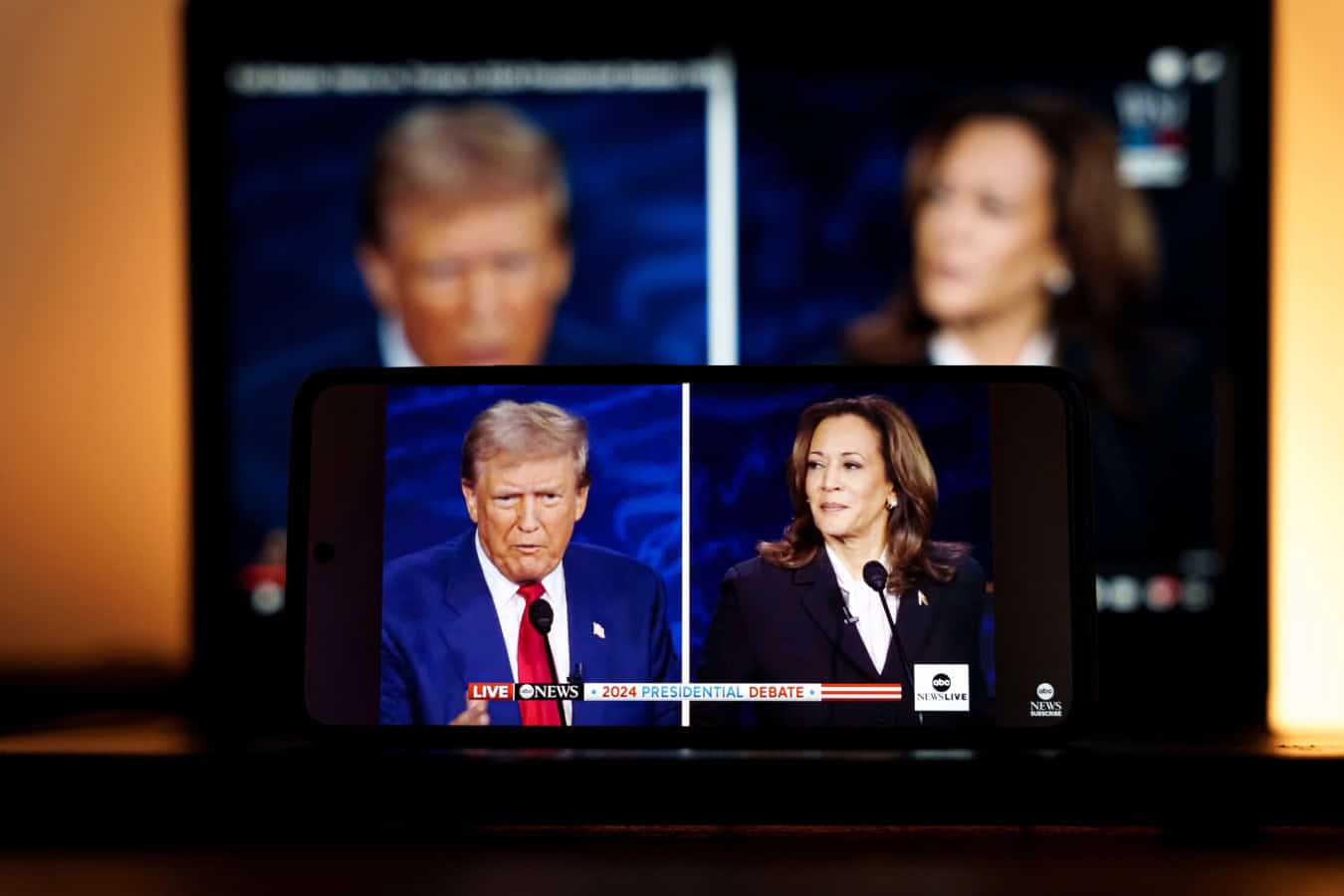

Trump’s Criticism of BLS Gains New Weight

President Trump had repeatedly criticized the BLS, claiming its job numbers were inflated to favor Democrats during the 2024 election and fired former commissioner Erika McEntarfer amid controversy.

This week’s historic revision, coupled with the Labor Department’s investigation, gives his claims fresh traction.

Trump’s team and the White House argue the data confirms their long-standing claim that official job numbers misrepresented the economy’s health under Biden.

Bessent and National Economic Council Director Kevin Hassett criticized the BLS ahead of the agency’s revisions, as Bessent said, “I’m not sure what these people who collect the data have been doing,” while Hassett suggested recent downward revisions are “why we need new and better data.”

Political Fallout Ahead of the 2024 Election

The revised data has major political implications.

Analysts note that Trump’s skepticism of BLS numbers during the 2024 campaign now appears prescient.

The figures call into question the state of the job market heading into the election, potentially reshaping narratives around Biden’s economic stewardship and bolstering Trump’s credibility with voters.

History of Large Revisions

This is not the first time BLS data has been substantially revised.

Last year, the BLS issued a downward revision of 818,000 jobs for the same annual period, reducing the average monthly job growth for the 12 months ending March 2024.

The downward revisions announced last year during election season confirmed what many Americans had been experiencing in the job markets.

Why the BLS Got It Wrong

BLS officials attribute the discrepancy to survey limitations.

The monthly report is based on about 121,000 employers, and businesses that don’t respond or newly formed firms aren’t immediately counted.

The agency’s birth-death model, used to estimate new business openings and closures, failed to fully account for new economic shifts. Consequently, job growth was overstated for more than a year.

Economists Defend BLS, Call for Reform

While Trump and his advisers have seized on the revisions as proof of data manipulation, professional economists stress that revisions are a normal part of the process.

The National Association for Business Economists defended the BLS workforce, calling them “dedicated professionals” but acknowledged that the agency’s data models; particularly the “birth-death” model for new businesses have struggled since the pandemic.

Largest Revision Since the Financial Crisis

By total numbers, the BLS report marks the largest preliminary revision since record-keeping began in 2000. Measured by percentage of total jobs, it’s the biggest adjustment since the 2009 financial crisis

Trump’s firing of BLS chief McEntarfer and replacement with Heritage Foundation economist E.J. Antoni has sparked debate about politicization of data.

The White House said the revisions underscore the need for new leadership at the BLS, while Democrats blasted Trump’s replacement pick, economist E.J. Antoni, as unqualified.

Meanwhile, markets, policymakers, and voters are left weighing whether the job market is far weaker than originally believed.

What Comes Next

The August revision is preliminary, with a final adjustment due in February 2026. Economists caution that while the number may soften, the trend is clear: the U.S. job market has been overstated, and confidence in government data is eroding.

With an official probe underway, the future of how America counts jobs may now be on the line.

Like Financial Freedom Countdown content? Be sure to follow us!

Retirement Dreams on Hold as 73% of the Sandwich Generation Support Parents and Adult Kids, Survey Finds

If you’ve ever flown on a plane, you know the drill: “Put your own oxygen mask on first before assisting others.” It’s easy advice to hear, but much harder to live by — especially if you’re caring for aging parents and supporting children. Welcome to life in the sandwich generation. Many people in their 40s and 50s face this dual responsibility right when their own retirement savings should be hitting full speed. A new survey conducted by Athene of the Sandwich Generation, found that nearly three quarters (73%) of respondents have adjusted their retirement goals to support their adult children or aging relatives, including: – Delaying retirement (34%) – Using retirement assets to support their family (22%) – Not planning to retire at all (9%) If you’re feeling squeezed from both sides, you’re not alone. Here’s what you need to know to survive and thrive during this overwhelming phase of life.

Treasury I Bond Rates Increases from 3.11% to 3.98% – But with a 1.1% Fixed Rate Locked for 30 Years, Is It Still a Smart Investment?

Inflation has become a significant concern. During the past three years of surging inflation, I bonds offered a safe and attractive investment option. However, with recent lower CPI numbers, the current composite rate for I bonds bought after May 1, 2025 will be 3.98%. The rate has slightly increased from the prior 3.11% but is a sharp decline from the enticing 9.62% annual rate available in May 2022 or even the 4.28% available for bonds purchased before October 31st, 2024. As rates decrease, investors are now considering whether it’s still worth buying Series I bonds.

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.